The Securities and Exchange Commission's Contempt for the Crypto Industry Has Never Been Secret. Over the Past Decade, The Agency Has Launched Hundreds of Lawsuits Against Outright Madsters and Wellestablished Crypto Businesses Like Coinbase. But its recent charges Against Cumberland, A Chicago-Based Trading Firm, Represented a Major Shift.

This article dives deeper into the sec's charges against cumberland and why it reprresents a more aggressive stance against the industry. We'll so look at how the incoming trump administeration could change that policy and what's next for the industry.

What happened?

On October 10, 2024, The Sec Cumberland with Operating as An Unregistered Dealer, Buying and Selling Crypto as Securities for Its Own Accounts and As part of Its Regular Business. The Agency So Alleged that the Company Traded Crypto Assets Offered and Sold as Investment Contracts On Third Party Exchanges.

The Sec's complaint Against Cumberland DRW Makes Several Allegations, But None Reference Outright Mad, Unlike the Agency's other Cases. Source: Sec Complaint

According to the complaint, “Cumberland, The Respective Issuers, and Objective Investors Treated the Offer and Sale Of Crypto Assets at Issue In This Case as Investments in Securities, and Cumberland Profited from Its Dealer Activity in Thesis Assets Without Providing Investors and The Market The Important Protections Afforded by Registration. ”

The MOVE FOLLOWS A Flurry of Other Crypto Enforcement Actions Last Year. In 33 Cases, The Sec Collected Nearly $ 5 Billion in Penalties. Of course, the caveat is that Terraform Labs, which Settled for $ 4.55 Billion Following the $ 40 Billion Implosion of the Terrausd Digital Token, Received the Majority of Those Penalties.

In Cumberland's Case, the complaint Seeks permanently injunctive relief, disgorgement of ill-gotten gains, prejudgment interest, and civil penalties.

This is different

Unlike the Sec's other Cases, the complaint Didn't MENTION ANY Fraudulent Behavior Alongside the Charges for Unregistered Securities Dealing. There was no water trading or other manipulative behavior or investors that lost money from the firm's actions. In fact, the firm has an excellent reputation within the industry and is known for its focus on compliance.

That's Because Cumberland is more than a niche digital asset dealer-it's a subsidiary of the chicago-base high-frequency trading company, drw. In June 2024, The Company Went to Great Langths to Secure A Coveted Bitlicense from the New York State Department of Financial Services (NYDFS), Attracting Institutional Clients to Its Roster.

The Company Buys and Sells Cryptocurrencies on Major Crypto Exchanges and Trading Platforms, Including Bitcoin, Ethereum, Solana, and Polygon. AS A Market Maker, ITS Trading Adds Liquidity to Thesis, Ensuring Price Efficiency and Making Trading Easier – Eespecialy for Institutional Investors Placing Large Orders.

For example, the company was one of the trading firms chosen by fidelity Investments to buy and sell bitcoin for it spot bitcoin etf, which befe befran trading in January 2024. Remains The Most Popular StableCoin in the Market.

A letter history

The Sec's Charges in October of Last Year Aren't Cumberland's First Run-in with Sec Chairman Gary Gensler. In 2013, The Commodity Futures Trading Commission (CFTC) SUED DRW Investments LLC – Cumberland's Parent Company – For Rigging Interest Rate Swaps Over Seven Months in 2011, General About $ 20 Million of Illegal Profit.

A Federal Judge in Manhattan Dismissed the Lawsuit in 2018, which led by Gary Gensler During his tenure at the cftc. The Judge Found that the Trades Had a Legitimate Economic Rational for Enticing Buyers in an OtherWise Illiquid Market. In addition, The Judge Believed the Defendant Sincerely Thought the Contract was Worth More Than The Bids.

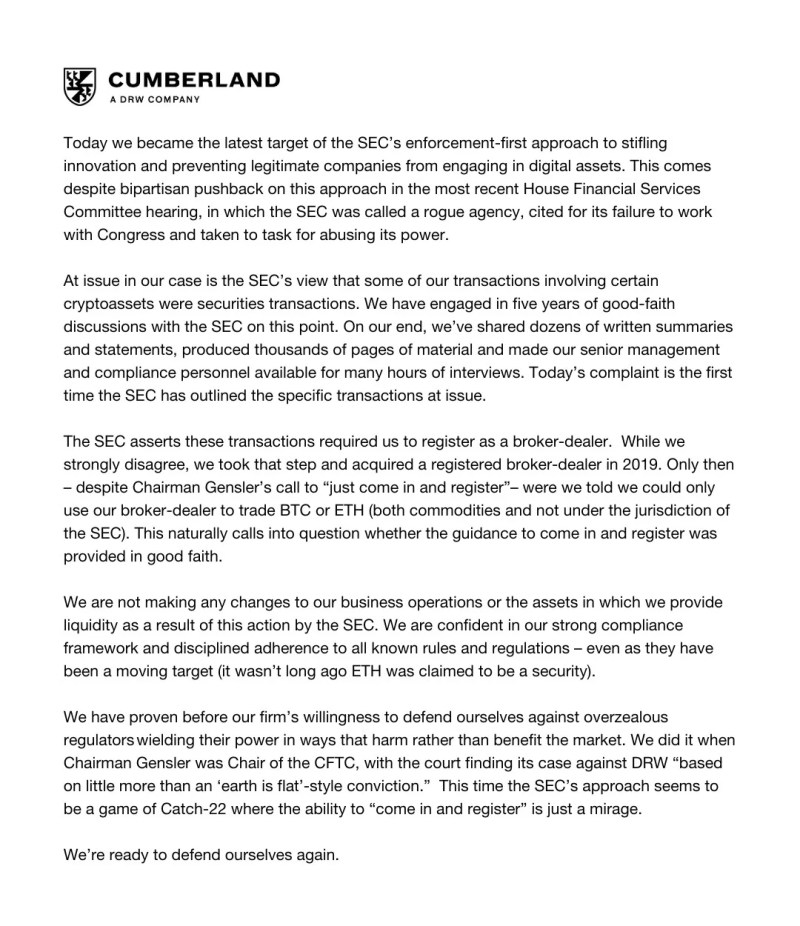

Cumberland Posted a Statement on X Promising to Fight Back Against The Sec's Allegations and Pointing Out the Past Case With The CFTC. Source: X

For its part, cumberland has promised to fight back against the sec's allegations. It Recalls Its Fight Against The CFTC, Saying It Suc peded in ITS PREVIOUS FIGHT AGAINST “Overzealous Regulators” and is “Ready to Defend Ourselves Again.” Furthermore, the statement made it clear that the company had already tried to comply as much as it would in 2019.

Does it matter?

President Trump's Victory in the 2024 Election Promises to Transform the Sec's Approach to Crypto Enforcement. That's Because Chairman Gary Gensler, Who Led the Crusade Against The Crypto Industry, is Being Replaced by Paul Atkins, A Former Sec Commissioner Known for his Pro-Business and Pro Crypto Stand. And that Could Impact This Case Along with many other.

When Atkins Takes Over As Chairman, The Sec Could Choonse Not to Prosecute Any Non-Fraud Cases and Cede More Crypto Regulation to the CFTC. Thesis EFFORTS COULD Free Up Resources To Continue Pursuing Instance of Outright Mad. For its part, the CFTC has Historically Taken a Lighter Approach to Enforcement, Making It Crypto's Preferred Regulator.

That Said, While the Sec May Change Course, Its rehearsal Could Lead to other Agencies Taking Action. For instance, the Department of Justice Recently Secured A $ 3 Billion settlement With Td Bank for Not Adequately Monitoring Its Customers' Transactions. Given Cumberland's Relationship with Tether, Some Believe Its Activities Could Be Scrutinized Differently.

The Bottom Line

The Sec's Enforcement Action Against Cumberland Represents to Escalation from Many Previous Targets. Unlike other Cases, Wash Sales or Market Manipulation is not mental. Instead, The Agency Seems to Target One of the Largest Market Makers Despite Its Efforts to Register with New York Financial Regulators.

While the Sec's Actions Against Cumberland Could Reverse During the New Administration, Regulators wants Still Keep Coming After Outright Mad. This included taxpayers who ignore or neglect their obligation to report capital gains and pay taxes on those gains.

If you Trade Crypto Assets, Zenledger Can Help You Organize Everything for Tax Time. Our Platform Tracks Your Capital Gains and Losses Across Accounts, Helping You Prepare for Your Tax Obligations Each Year. And we can help you save money by identifying opportunities for tax-free harvesting.

Get Started Today for Free!

This material has been Prepared for Informationally Purposes ONLY and Should not be interpreted as professional Advice. Please Seek Independent Legal, Financial, Tax, Or other Advice Specific to your particular situation.