DCA strategy Or “Dollars-Cost Averaginging»Allows investors to access a market thanks to an average cost by smoothing the investment. It reduces the risks of a investment in cryptocurrencies.

This article initially presents the last episode of high volatility that experienced the market cryptocurrencies. We will answer the question: what are the reasons for these strong price movements? Then we will present a concrete example investment via DCA strategy so that it is clearer for all readers. And finally, The investor will be able to discover investment thanks to strategie Dca From the Feel Mining company through a mini tutorial.

Definition of basic concepts

The DCA method

The method “Dollar-Cost Averaginging“, THE Dcaconsists of a periodic purchase with a determined sum. This is a strategy investment consisting of invest Regularly the same amount of money on the same support regardless of the market state.

The main objective of this method is to guard against volatility associated with financial markets.

Why is volatility so strong in the cryptocurrency market?

- The evolution of a market

In general, markets need to be built, thanks to four key stages. In order, the market begins with accumulation, increase, distribution and the decline phase. These steps are essential for the coherent operation of a market regardless of the support (s).

The market was born as a result of the creation of cryptocurrency Bitcoin, 12 years ago. How could a market that just arise could have perfect stability?

In reality, it depends on the total capitalization of a market. The higher the liquidity, the more difficult it is to vary the price. Today the market of cryptocurrencies represents just over $ 2000 billion in value.

Global regulation is gradually being set up, but risks remain about cryptocurrencies. What will they become? What will the high regulatory markets of the markets define about this new asset class?

It is true that the market of cryptocurrencies is a market that wants to be open and accessible to everyone thanks to digitalization and technology. This gives everyone or anyone the opportunity to be able to invest.

And all the more it opens the door to new investors Beginners and not initiated. We can conclude that the euphoria phases are increased tenfold, and in the other direction, the panic movements are just as much.

To conclude, it is legitimate that periods of strong volatility can exist on the market of cryptocurrencies. Because it is a very recent market with low capitalization and investors Novices, it is likely to have stronger movements. The DCA method is one of the assets of investors in order to protect yourself from this volatility.

Concrete example of an investment via the DCA strategy

Take the example of a investor that started DCA strategy To buy bitcoin since the start of 2021. The blue line represents January 1, 2021 and every 15th of the month, Alice buys for $ 100 Bitcoin. Each purchase is represented by an orange line. The graph below represents the evolution of the price of bitcoin compared to the dollar in the year 2021.

Since the start of the year, the investor has bought Bitcoin 8 times for a total amount of $ 800. Let us detail each month the unit price of Bitcoin when it is purchased:

- January: $ 39,123

- February: $ 48,668

- March: $ 58,977

- April: $ 62,970

- May: $ 49,912

- June: $ 40,541

- July: $ 32,816

- August: $ 47’110

Each month, The investor bought for $ 100 Bitcoin, the average purchase cost of its Bitcoins is around $ 47,514, not to mention the potential costs. On the previous image, the Bitcoin price was $ 48,512 which proves that The investor does not lose money at the moment. DCA strategy For invest is simple and its main advantage is to follow the market as best as possible, regardless of the trajectory it takes.

No need to know the basics of trading, you also need to look at the price of bitcoin every day. It is one of the best solutions in order to invest and enter a market without worrying about the price. Investment is guided by the strategy decided upstream, that is to say the monthly amounts invested as well as the duration of investment.

Let us discover together the advantages and disadvantages of this DCA method which has already proven itself.

Benefits

- Simplicity, ease

- Save time

- Reduces risk in the face of volatility

- Market the market stress

- Securing an investment

Disadvantages

- Reduces % of the gains if increased courses

- Increases investment costs

The DCA method – Feel Mining

In order to best support his investorsthe company offers The DCA method as a strategy investment On two offers, the direct purchase of cryptocurrency and the monthly investment packs.

Let us discover together how this investment Works on the Feel Mining interface.

Simplicity, ease, speed, so many adjectives that would be likely to describe the service offered by the Feel Mining teams. How invest With as little risk possible?

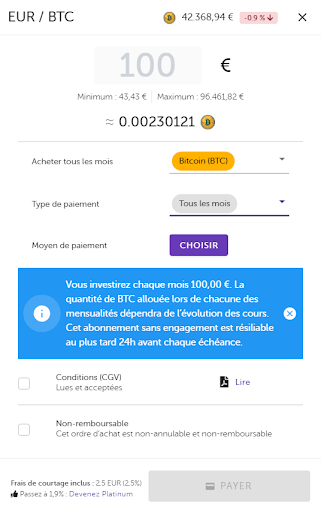

The DCA method As described previously in this article allows you to best follow the market regardless of associated volatility. After validating the registration, a banner will be available in the user interface to select the option “Buy cryptocurrencies».

That’s not all, you can also buy LTC as well as dowry, in addition to the BTC and the ETH, initially offered.

After choosing the crypto-active as well as the amount of your monthly investment, click on the PAY button. Your cryptocurrencies will be paid inside the corresponding scale each month, from the date of subscription of the contract.

Conclusion

The world of cryptocurrencies is brand new, volatility as well as the lack of regulation on this market are factors to increase risk. What could be better than a platform listening to investors as well as regulation?

Feel Mining is a platform validated by AMF and has the PSAN to sell digital assets. The investor is first of all within a regulated environment which reduces the risk of scams.

Feel Mining offers The DCA method on the direct purchase of cryptocurrencies but also on investment packs with the possibility of monthly contribution.

It is a simple, flexible, rapid and easier method than the non -recurring purchase due to significant volatility on this market.

The DCA method is a strategy that is bearing fruit for everything investor in the field of cryptocurrencies and blockchains.

If you want to know more, do not hesitate to consult our podcast on the subject

Stan

“Chancellor on brink of second lease for banks”

The lonely man thinks alone and creates new values for the community