Welcome to this weekly market analysis!

This article is today dedicated to BTC & ETH.

Slight resumption of crypto, has the crisis have passed?

Aland Crypto is not in its best form. These last complex weeks of state directing, cryptocurrencies diverting downwards for the old new hollows (notary on the side of altcoins).

However, with the break put in place by Donald Trump vis-à-vis customs officials pays a duration of 90 days, the steps ralisen the drop and mark a time in the downward dynamics that know the Moiss of January.

The vociet cryptocurrencies this as a new favorable to a stress. In recent days, the courses have been in the green, Bitcoin has been able to iron over the $ 85,000 and Ethereum stops saying the $ 1,000.

However, the threat of customs tariffs continues to hover over financial heads. Many pay-negotiation pays with the White House. The European Union would have offered a new trade agreement after the Insaurée truce.

Parallel, confidence in the United States gradually crosses. Many pays the vocation of a bad eye the protection policy of Trump. It is Notary the case of China, which exhorts the European Union to the reservator Sees links with Pekin for the US counter-Hégémonie on world trade.

It is a real showdown that takes shape today. What is certain is that it is not ready to end. Let us take stock of the situation of BTC and ETH lessons, take stock of the previous weeks and establish the bias to have to come to May.

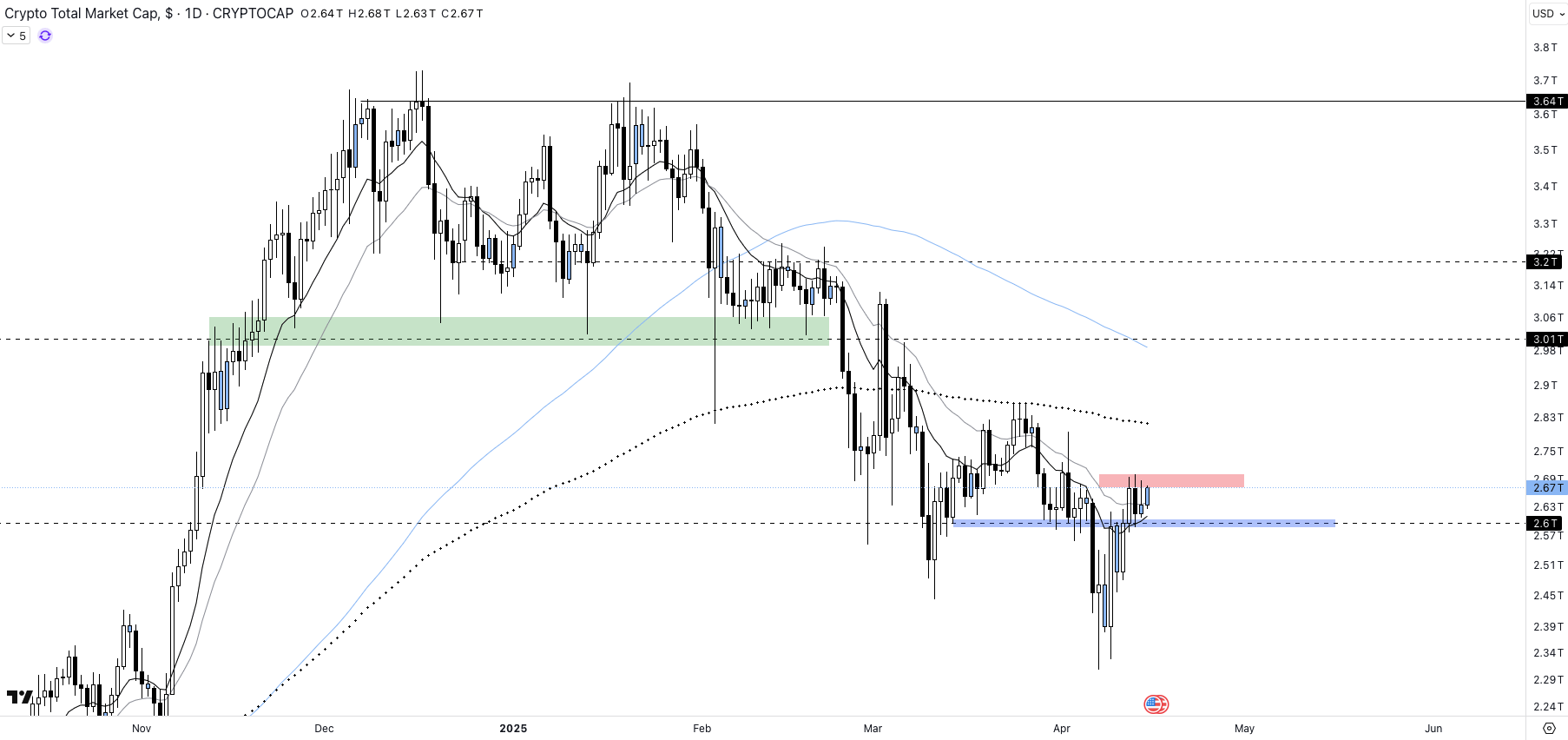

Key moment to the capital Total market

The capitation of cryptocurrencies is left to include a rebound on the EMA 200 that the planes of weapons identified last. Last hope in the short term, this recovery on this mobile average suggests continuity of force bought in the coming weeks.

However, nothing is played. The market is found to be difficult under the united confluence of resistance including the MA 100 and the EMA 13. Lightly regaining the terminal of the previous range, a large, a quick, is a good news for the next.

In order for this rebound to have a greater dimension by bringing the market to more than $ 3,000 billion, it is a transition to more than $ 2,800 billion which will also have to be inscribed.

This opera area as a resistance since March. An increase in the rise signifying that the sellers feels actually on the Touch.

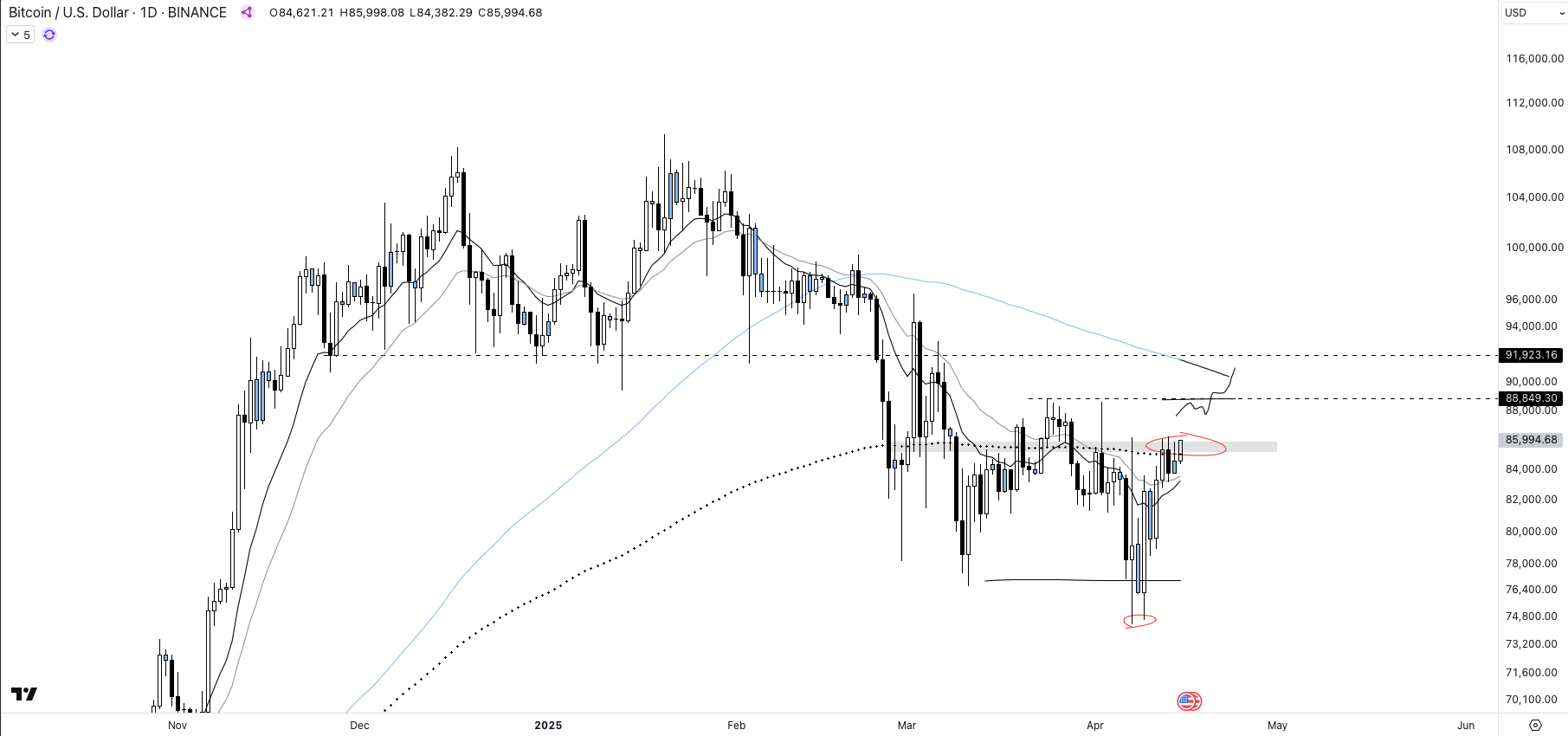

Trend return confirmed on Bitcoin?

Faison's a small update of our graphics on the king of cryptocurrencies. A few trors earlier, a low balayage a place to repeat the liquidity accumulated last February and March under the $ 75,000.

The news rebound testifies to a significant buying force. Pouring Bitcoin, let the moment are decisive: after having crossed the EMA 13 & 25, the next key objective is now to reconcile the pivot of 85,000 dollars (confluence zone with EMA 200).

Just above being located at 88,800 dollars and 91,900 dollars. These are the last two zones which for the for arteurs putrre BTC in difficult avenc la MA 100. To flow this athu can be old, here are the two levels that dofitose flip as a support.

As long as Bitcoin evolves Danans this narrow rage, a return against his prerédets sum cannot be considered as certainty a certainty, the computer without the current macroeconomic threats.

With the meeting of the Fed (FOMC) to come on next 6 and 7 May, the timing could be ideal for a summer in the cryptocurrencies. This will deduct in a very partitity of the decision as to the drop in rates with the air contribution of liquid on the steps and the evolution of the negotiation processes within the framework of Trump's policy.

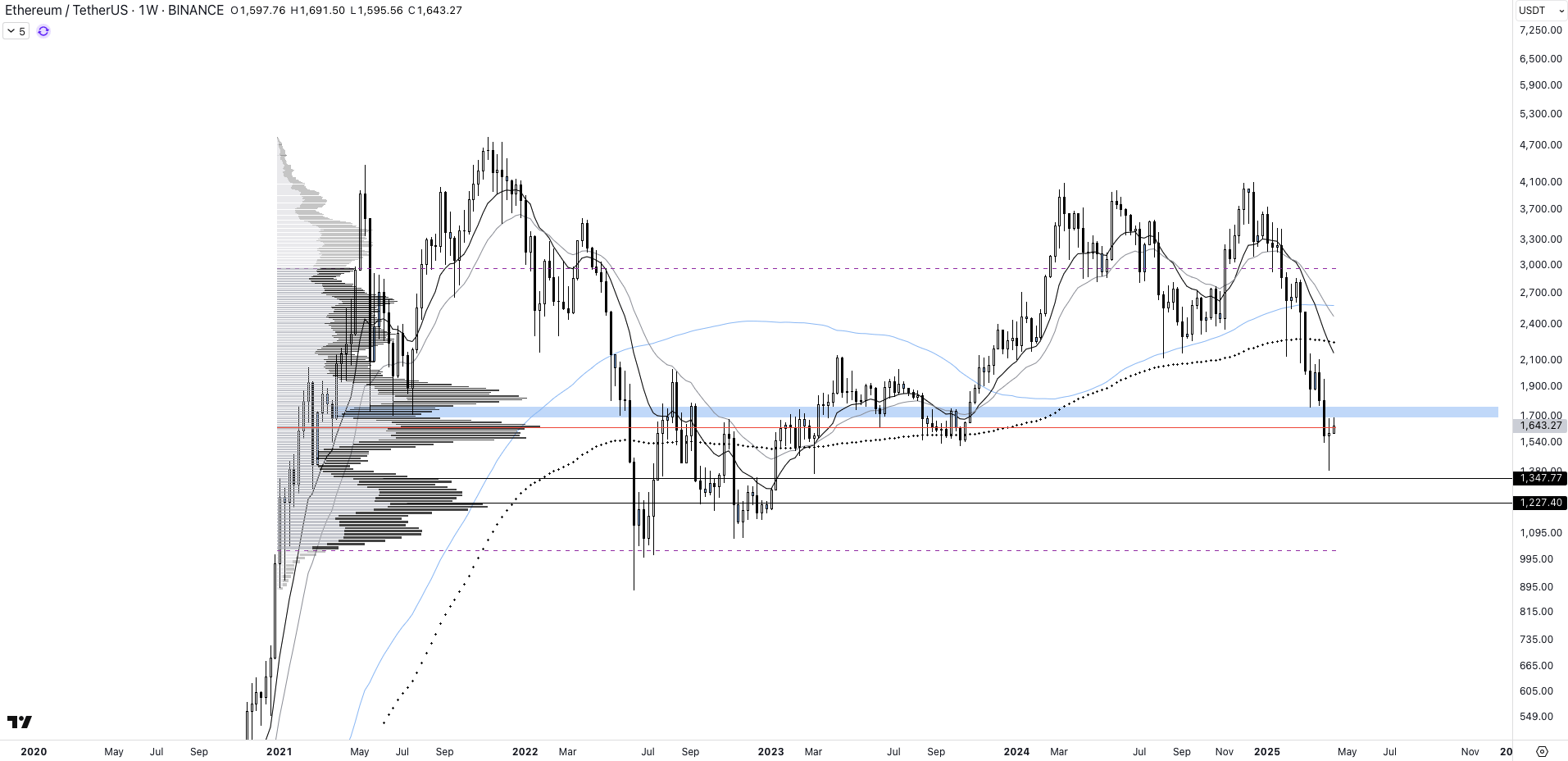

Ethereum: pessimism at most the skin

Analysis of this competition, can be used on the ETH cryptocurrency of the Ethereum blockchain.

In recent months have been marked by a very strong fall in the second activity of the market, the liquidity remaining on Bitcoin, which explains the maintenance of the King of Cryptomonnaoes at 80,000 dollars to allow him to restrom the real market leader.

Having lost the $ 1,700 area (Pivot Histority since 2021), the situation is rather critical for ETH. However, nothing has yet been played, the assets are currently entrusting this area and the POC of the volume profile.

Ideally, not rebound must take place during Procour to allow Ethereum to take up the mature area in blue on our graphics. If he does not succeed, he will say progressive towards the $ 1,347.

On the ETH / BTC pair, the situation is even more complex. However, the reppli on and support the representation to penetrate it with an opposition to the axtive – provided they maintain an optimistic vision as for:

- The evolution of the Ethereum network

- His ability to establish himself as a multi-utility token (beyond his simple role as 'Gas Token')

With the arrival of the Pectra update, the dynamics will evolve and allow ETH to find ÜT during the next semines? With a timing of deployment on the Mainnet in confluence with the intentigung of the Fed, volatility may be at the height the first half of May.

Yields

Young enthusiast of financial marches and particularity of the world of cryptocurrency, the technical alsyses and the involvement make game of my routing to create arionable content.