The end of the green card

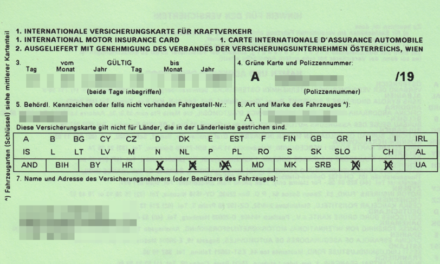

Renewed each year by insurers, the green card is deeply rooted in the habits of drivers. This paper document, which includes an insurance certificate and a sticker to affix on the windshield, makes it possible to prove that a vehicle is well guaranteed.

However, It will disappear on April 1, 2024 : From this date, the police will carry out their controls directly by consulting the file of the insured vehicles (FVA), which compiles all the car insurance contracts in France.

The physical nature of the green card has several drawbacks, which justify this Evolution of auto insurance regulations. For example, a forgetting of the butterfly renewal on the windshield is likely to cause verbalization, while the driver is indeed assured. Without forgetting the ecological cost of these thousands of small papers, whose printing and expedition would generate 1,200 tonnes of CO2 per year.

Finally, this reform aims to facilitate control of the compliance with the insurance obligation Drivers, in order to combat traffic without insurance.

An inevitable price increase

Following the request of the Minister of the Economy, insurers have endeavored to maintain the price increases in terms of inflation for the year 2023. However, consequent increases are expected in 2024.

First of all, the return to pre-Cavid habits resulted in a boom in the use of the car by the French. A phenomenon that logically generates a multiplication of accidents, but also an increase in bonuses calculated according to the number of kilometers traveled.

The increase in auto insurance rates is also linked to Office of the prices of spare partswhich is explained by different factors:

- Car manufacturers have no monopoly on spare parts since the entry into force of the climate and resilience law on August 22, 2021. However, the opening of the market to independent repairers intensified competition, resulting in prices.

- The parts in themselves are more and more complex and costly to produce, in particular because of the growing popularity of SUV type vehicles.

- The current geopolitical context has a direct impact on the price of certain raw materials.

Finally, the development of claims related to climate change necessarily affects insurers' prices.

The permit at 17 years old

Since January 1, 2024, The minimum age required to obtain the driving license was lowered from 18 to 17 years old. As for examining the highway code, compulsory to pass the driving test, it can be passed from 15 years for people enrolled in accompanied driving, and from 16 years for others.

Previously, it was possible to obtain the driving license at 17 years thanks to the early learning of driving. However, it was necessary to wait for the age of majority before being able to drive independently.

Announced in June 2023 by Prime Minister Élisabeth Borne, this measure is intended for Promote the mobility of young peoplebut also to facilitate their emancipation and access to studies and employmentespecially in rural areas.

A novelty that can raise certain questions, particularly in matters of responsibility. As a reminder, in the event of a road offense, the driver engages his criminal responsibility, including if it is a minor. However, the civil liability lies with the legal representatives of the driver to his majority. In other words, Parents are responsible for the damage caused by their child.

Thus, the lowering of the minimum age for obtaining the permit should bring many minors to Ensure as secondary drivers on their parents' car insurance contract. For an increase, this advantageous alternative allows the young driver to occasionally use the vehicle of a loved one by being covered by his liability warranty, while combining bonus.

Another possibility: to subscribe on behalf of insurance with a formula adapted to the driver's profile. A less economical option, as significant surprises are applied to people who recently obtained their license. However, this solution is essential if the young driver is the main user of the vehicle.

Recall that any owner of an engine vehicle in circulation in France has the obligation to insure it, with at least the liability guarantee – also called “third party insurance”. This liability insurance is used to compensate victims of the damage caused by the vehicle.