Each year, cryptocurrency holders must declare their more or losses of the past year in their tax return. The year 2023 does not escape the rule.

There are two reporting obligations according to article 150 VH bis of the general tax code. These are:

- The obligation to declare its accounts of digital assets held used or closed abroad during the year in form 3916-Bis.

- The obligation to declare its taxable transactions and more or losses carried out on digital assets in form 2086.

In the event of a declaration omission, potential sanctions are provided for by law. The French taxpayer is notably exposed to a sanction of € 750 per unconceived account. Amount can be doubled if the market value of digital asset accounts is greater than € 50,000.

It is therefore essential not to miss your declaration and to be in good standing with the tax administration each year. But we will come back to this in the course of this article.

What dates for the declaration of his cryptos in 2023 ?

Each year, Cryptos investors must declare their capital gains of the past year in a specific tax period which is joined to that of the declaration on its income.

This year the declarative income tax campaign begins on April 13, 2023 with the opening of the online declaration space on the tax administration website.

As every year, the declaration is possible in paper version or in digital version directly on the official website of the tax administration.

During this fiscal period, taxpayers must, in addition to their declarations of taxable transactions and more or losses carried out on digital assets, also declare the holding of their Cryptos accounts based abroad to the tax administration.

For the paper version, the period is shorter than the digital version, it ends on May 22, 2023.

Regarding the online declaration, the dates depend on the taxpayer's residence department:

- Departments 01 to 19: May 25, 2023

- Departments 20 to 54: June 1, 2023

- Departments 54 to 976: 08 June 2023

This year's dates are important to know in order to provide and file its declaration of capital gains on digital assets in time.

Feel Mining: What risks not to declare its declarative obligations in crypto?

In France, the tax system and its operation is based on the confidence of taxpayers with the implementation of a declarative system. If an investor or trader Crypto omits his declaration, the tax administration considered that this confidence is betrayed. In the event of a declaration omission it could cause several criminal and financial sanctions.

First of all, it is necessary to separate the defect of declaration of Crypto account held abroad from the defect in declaration of capital gains made on digital assets.

Regarding the absence of a declaration of account abroad, the taxpayer who has not declared the detention of a account held in a third country to France is exposed to various sanctions:

-The General Tax Code (CGI), in its article 1736 provides that the non-declaration of a foreign digital asset account is sanctioned by a fine of 750 euros by unsuccessful account. This amount amounts to 1,500 euros If the account concerned exceeds the valuation of 50,000 euros.

Important: you don't have to declare your feel mining accounts in this form because they are French accounts. Only accounts held abroad and of which you are not the direct manager of your funds are to be declared (Custodial accounts).

Regarding the sanctions in the absence of a declaration of taxable transactions and the more or loser-values made on digital assets, it depends on several elements and the good faith of the taxpayer.

- In the most serious cases, that is to say the voluntary omission of declaration of gains in cryptocurrency, the consequences are important because the taxpayer is exposed to criminal sanctions with a legal qualification of tax fraud. To this end, the maximum sanctions applicable to tax fraud can go up to 3 million euros, and a prison sentence of 7 years.

- In the event of a non-effective declaration due to errors in the calculation of added value and thus in the declared amount, the sanctions are variable depending on the severity of the errors made. For a simple non-determining error, the increase will amount to 10% of the taxable amount and may be canceled in the event of rectification of the latter within 30 days of the discovery of this error. According to the good faith of the taxpayer, a cancellation of the sanction may be envisaged.

How to calculate my taxable more or losses?

First, let us define together what a taxable operation is.

There are two facts generating taxation:

- The conversion of a cryptocurrency against a state monetary currency (euro, dollar, etc.)

- Buying a cryptocurrency property or service.

As soon as you carry out one of these operations, you must declare your taxable more or losses on each operation.

For that, here is the calculation formula: Sale price – (total net acquisition price x transfer price / overall value of the portfolio before sale)

You will therefore need all of his information in order to obtain a fair calculation:

- The total amount invested in cryptocurrencies in Fiat currency.

- The date of each operation.

- The total value of your crypto wallet valued in Fiat at the time of each operation.

And that's why the tax system in France is complex. You will need Value your entire wallet at the time of each operation In order to correctly calculate your more or less values.

Fortunately, a solution exists. Thanks to Waltio, You can automatically calculate your capital losses thanks to their cryptocurrency accounting software.

So let's see together how to enter your transactions from Feel mining On Waltio so that you can properly declare your cryptocurrencies.

How to enter my feel mining transactions on Waltio?

You can recover your transaction history in “CSV” format on your feel mining account. For that :

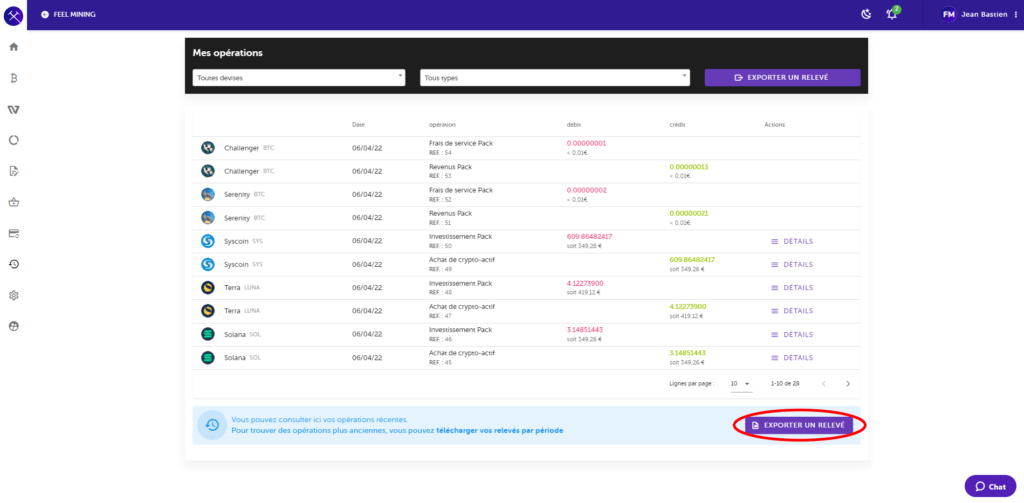

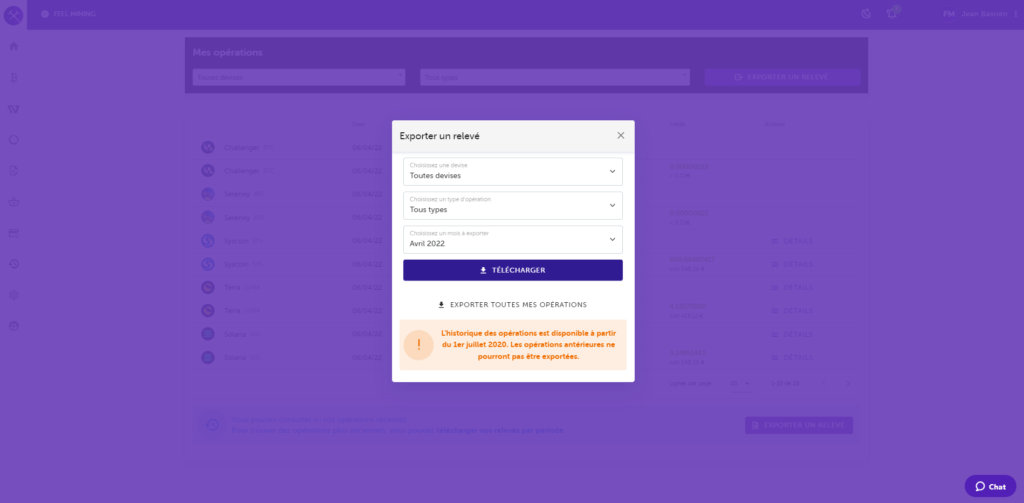

Go to your “Dashboard”. Click on “Operations” Then once on your history, click on ” Export “.

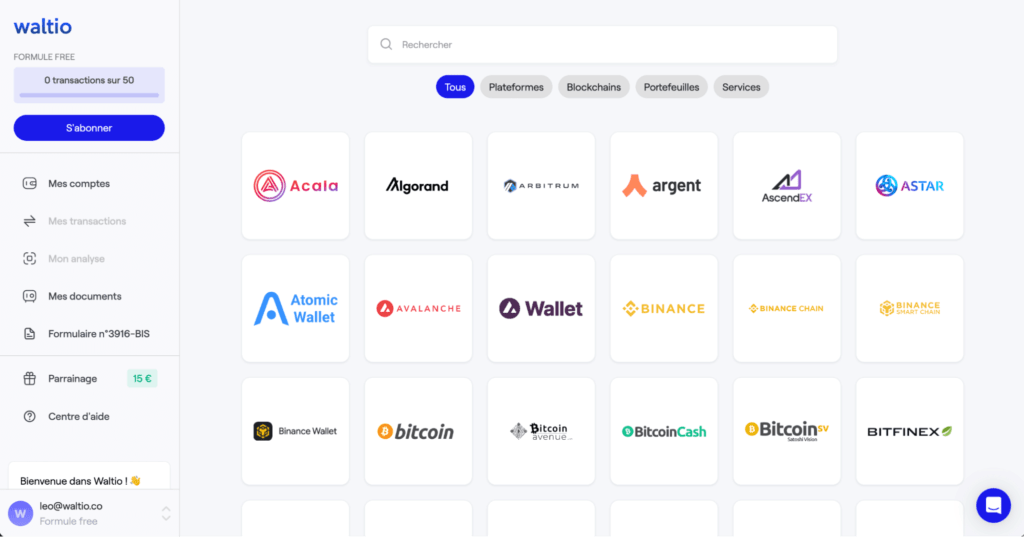

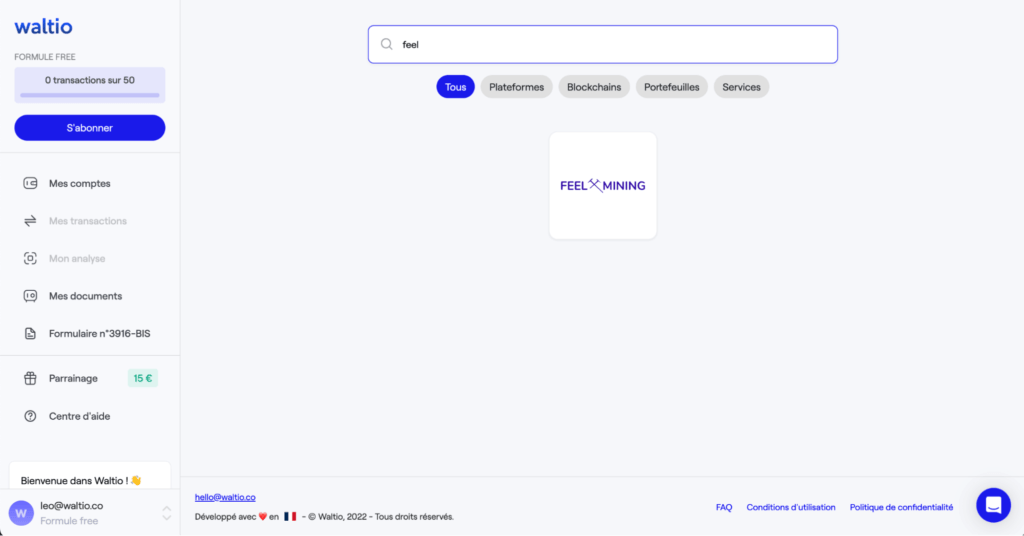

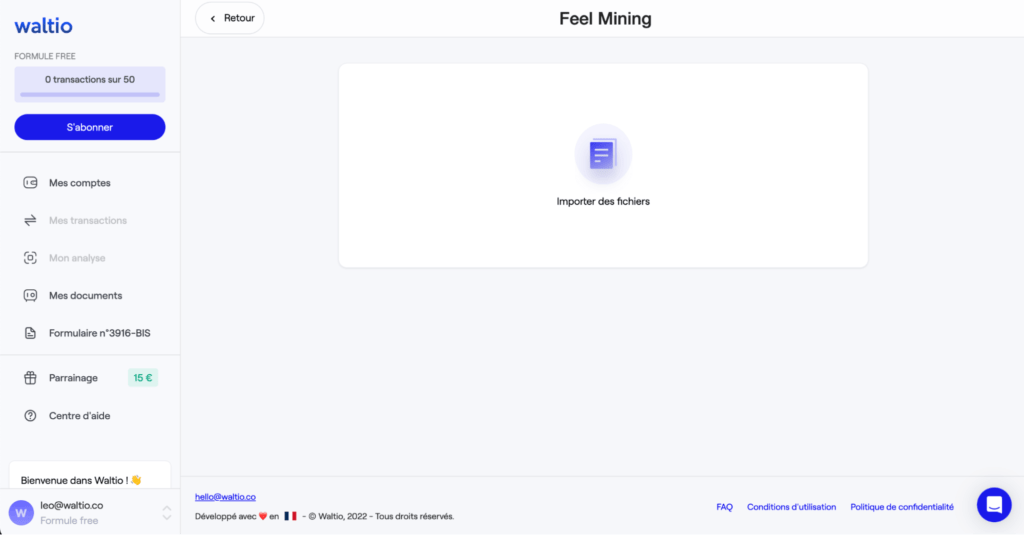

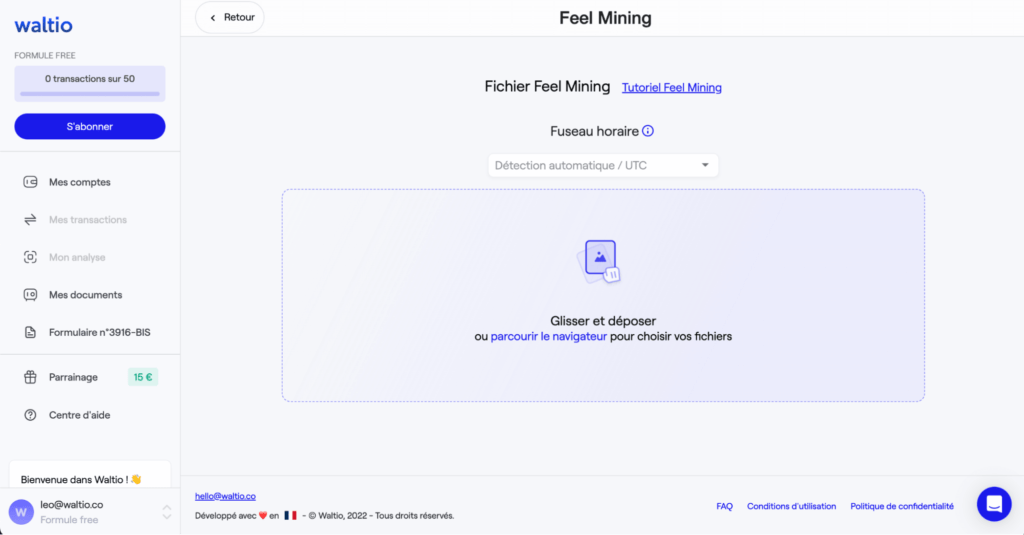

To deposit it on Waltio, simply go to the section “Add an account”to choose Feel Mining and to set off your file.

Once your file is filed, Waltio will be able to calculate your capital gains on you.

Cryptocurrency taxation is a complex subject. For all other crypto-fiscal information, we invite you to consult the Waltio FAQ or write to them [email protected]

We remain at your disposal on our chat from 9 a.m. to 5 p.m. Monday to Friday to accompany you on our platform and for all requests relating to taxation, do not hesitate to consult our partner who will be happy to orient you in your efforts.